About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 363 results for "Noé Guiraud" clear search

An Agent-Based Model of an Insurance Market driven by Supply and Demand with Imperfectly Estimated Strategies in C#

Rei England | Published Sunday, September 24, 2023This is a simulation of an insurance market where the premium moves according to the balance between supply and demand. In this model, insurers set their supply with the aim of maximising their expected utility gain while operating under imperfect information about both customer demand and underlying risk distributions.

There are seven types of insurer strategies. One type follows a rational strategy within the bounds of imperfect information. The other six types also seek to maximise their utility gain, but base their market expectations on a chartist strategy. Under this strategy, market premium is extrapolated from trends based on past insurance prices. This is subdivided according to whether the insurer is trend following or a contrarian (counter-trend), and further depending on whether the trend is estimated from short-term, medium-term, or long-term data.

Customers are modelled as a whole and allocated between insurers according to available supply. Customer demand is calculated according to a logit choice model based on the expected utility gain of purchasing insurance for an average customer versus the expected utility gain of non-purchase.

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

Peer reviewed An IBM of a fishing fleet exploiting a pelagic resource and with a fisher management system. A preliminary version.

Paul Hart | Published Tuesday, March 19, 2024A fisher directed management system was describeded by Hart (2021). It was proposed that fishers should only be allowed to exploit a resource if they collaborated in a resource management system for which they would own and be collectively responsible for. As part of the system fishers would need to follow the rules of exploitation set by the group and provide a central unit with data with which to monitor the fishery. Any fisher not following the rules would at first be fined but eventually expelled from the fishery if he/she continued to act selfishly. This version of the model establishes the dynamics of a fleet of vessels and controls overfishing by imposing fines on fishers whose income is low and who are tempted to keep fishing beyond the set quota which is established each year depending on the abundance of the fish stock. This version will later be elaborated to have interactions between the fishers including pressure to comply with the norms set by the group and which could lead to a stable management system.

Peer reviewed Zimbabwe Agro-Pastoral Management Model (ZAPMM): Musimboti wevanhu, zvipfuo nezvirimwa

MV Eitzel Solera Kleber Tulio Neves Jon Solera Kenneth B Wilson Abraham Mawere Ndlovu Aaron C Fisher André Veski Oluwasola E Omoju Emmanuel Mhike Hove | Published Tuesday, June 19, 2018This model has been created with and for the researcher-farmers of the Muonde Trust (http://www.muonde.org/), a registered Zimbabwean non-governmental organization dedicated to fostering indigenous innovation. Model behaviors and parameters (mashandiro nemisiyano nedzimwe model) derive from a combination of literature review and the collected datasets from Muonde’s long-term (over 30 years) community-based research. The goals of this model are three-fold (muzvikamu zvitatu):

A) To represent three components of a Zimbabwean agro-pastoral system (crops, woodland grazing area, and livestock) along with their key interactions and feedbacks and some of the human management decisions that may affect these components and their interactions.

B) To assess how climate variation (implemented in several different ways) and human management may affect the sustainability of the system as measured by the continued provisioning of crops, livestock, and woodland grazing area.

C) To provide a discussion tool for the community and local leaders to explore different management strategies for the agro-pastoral system (hwaro/nzira yekudyidzana kwavanhu, zvipfuo nezvirimwa), particularly in the face of climate change.

Peer reviewed An extended replication of Abelson's and Bernstein's community referendum simulation

Klaus G. Troitzsch | Published Friday, October 25, 2019 | Last modified Friday, August 25, 2023This is an extended replication of Abelson’s and Bernstein’s early computer simulation model of community referendum controversies which was originally published in 1963 and often cited, but seldom analysed in detail. This replication is in NetLogo 6.3.0, accompanied with an ODD+D protocol and class and sequence diagrams.

This replication replaces the original scales for attitude position and interest in the referendum issue which were distributed between 0 and 1 with values that are initialised according to a normal distribution with mean 0 and variance 1 to make simulation results easier compatible with scales derived from empirical data collected in surveys such as the European Value Study which often are derived via factor analysis or principal component analysis from the answers to sets of questions.

Another difference is that this model is not only run for Abelson’s and Bernstein’s ten week referendum campaign but for an arbitrary time in order that one can find out whether the distributions of attitude position and interest in the (still one-dimensional) issue stabilise in the long run.

SESPES: socio-ecological systems and payment for ecosystem services model

Eulàlia Baulenas | Published Sunday, December 20, 2020 | Last modified Sunday, December 20, 2020The purpose of this spatially-explicit agent-based model is to intervene in the debate about PES policy design, implementation and context. We use the case for a woodland-for-water payment for ecosystem services (PES) and model its implementation in a local area of Catalonia (NE Spain). The model is based on three sub-models. The structural contains four different designs of a PES policy. The social sub-model includes agent-based factors, by having four types of landowner categories managing or not the forests. This sub-model is based on behavioral studies and assumptions about reception and reaction to incentive policies from European-focused studies. The ecological sub-model is based on climate change data for the area. The output are the evolution of the ecological and social goals of the policy under different policy design scenarios. Our focus in Europe surges from the general context of land abandonment that many Mediterranean areas and Eastern countries are experiencing, and the growing interest from policy-makers and practitioners on the implementation of PES schemes to ameliorate this situation.

While the world’s total urban population continues to grow, not all cities are witnessing such growth, some are actually shrinking. This shrinkage causes several problems to emerge including population loss, economic depression, vacant properties and the contraction of housing markets. Such problems challenge efforts to make cities sustainable. While there is a growing body of work on study shrinking cities, few explore such a phenomenon from the bottom up using dynamic computational models. To overcome this issue this paper presents an spatially explicit agent-based model stylized on the Detroit Tri-county area, an area witnessing shrinkage. Specifically, the model demonstrates how through the buying and selling of houses can lead to urban shrinkage from the bottom up. The model results indicate that along with the lower level housing transactions being captured, the aggregated level market conditions relating to urban shrinkage are also captured (i.e., the contraction of housing markets). As such, the paper demonstrates the potential of simulation to explore urban shrinkage and potentially offers a means to test polices to achieve urban sustainability.

SiFlo: An Agent-based Model to simulate inhabitants’ behavior during a flood event

Patrick Taillandier Franck Taillandier Pascal Di Maiolo Rasool Mehdizadeh | Published Thursday, July 29, 2021SiFlo is an ABM dedicated to simulate flood events in urban areas. It considers the water flowing and the reaction of the inhabitants. The inhabitants would be able to perform different actions regarding the flood: protection (protect their house, their equipment and furniture…), evacuation (considering traffic model), get and give information (considering imperfect knowledge), etc. A special care was taken to model the inhabitant behavior: the inhabitants should be able to build complex reasoning, to have emotions, to follow or not instructions, to have incomplete knowledge about the flood, to interfere with other inhabitants, to find their way on the road network. The model integrates the closure of roads and the danger a flooded road can represent. Furthermore, it considers the state of the infrastructures and notably protection infrastructures as dyke. Then, it allows to simulate a dyke breaking.

The model intends to be generic and flexible whereas provide a fine geographic description of the case study. In this perspective, the model is able to directly import GIS data to reproduce any territory. The following sections expose the main elements of the model.

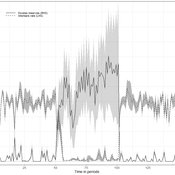

A basic macroeconomic agent-based model for analyzing monetary regime shifts

Oliver Reinhardt Florian Peters Doris Neuberger Adelinde Uhrmacher | Published Tuesday, May 03, 2022In macroeconomics, an emerging discussion of alternative monetary systems addresses the dimensions of systemic risk in advanced financial systems. Monetary regime changes with the aim of achieving a more sustainable financial system have already been discussed in several European parliaments and were the subject of a referendum in Switzerland. However, their effectiveness and efficacy concerning macro-financial stability are not well-known. This paper introduces a macroeconomic agent-based model (MABM) in a novel simulation environment to simulate the current monetary system, which may serve as a basis to implement and analyze monetary regime shifts. In this context, the monetary system affects the lending potential of banks and might impact the dynamics of financial crises. MABMs are predestined to replicate emergent financial crisis dynamics, analyze institutional changes within a financial system, and thus measure macro-financial stability. The used simulation environment makes the model more accessible and facilitates exploring the impact of different hypotheses and mechanisms in a less complex way. The model replicates a wide range of stylized economic facts, including simplifying assumptions to reduce model complexity.

Friendship Games Rev 1.0

David Dixon | Published Friday, October 07, 2011 | Last modified Saturday, April 27, 2013A friendship game is a kind of network game: a game theory model on a network. This is a NetLogo model of an agent-based adaptation of “‘Friendship-based’ Games” by PJ Lamberson. The agents reach an equilibrium that depends on the strategy played and the topology of the network.

Displaying 10 of 363 results for "Noé Guiraud" clear search