About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 334 results for "Chelsea E Hunter" clear search

An Agent-Based Model of Indirect Minority Influence on Social Change

Jiin Jung | Published Wednesday, February 05, 2025This model demonstrates how different psychological mechanisms and network structures generate various patterns of cultural dynamics including cultural diversity, polarization, and majority dominance, as explored by Jung, Bramson, Crano, Page, and Miller (2021). It focuses particularly on the psychological mechanisms of indirect minority influence, a concept introduced by Serge Moscovici (1976, 1980)’s genetic model of social influence, and validates how such influence can lead to social change.

Peer reviewed Simulating the Economic Impact of Boko Haram on a Cameroonian Floodplain

Mark Moritz Nathaniel Henry Sarah Laborde | Published Saturday, October 22, 2016 | Last modified Wednesday, June 07, 2017This model examines the potential impact of market collapse on the economy and demography of fishing households in the Logone Floodplain, Cameroon.

Social identity approach in a data-driven Axelrod model

alejandrodinkelberg | Published Thursday, July 28, 2022Simulations based on the Axelrod model and extensions to inspect the volatility of the features over time (AXELROD MODEL & Agreement threshold & two model variations based on the Social identity approach)

The Axelrod model is used to predict the number of changes per feature in comparison to the datasets and is used to compare different model variations and their performance.

Input: Real data

…

Competitive Arousal Agent Based Model

Zoé Chollet | Published Friday, May 13, 2022What is it?

This model demonstrates a very simple bidding market where buyers try to acquire a desired item at the best price in a competitive environment

…

Agent-Based Simulation for International Tax Compliance

Peter Gerbrands | Published Tuesday, July 18, 2023Country-by-Country Reporting and Automatic Exchange of Information have recently been implemented in European Union (EU) countries. These international tax reforms increase tax compliance in the short term. In the long run, however, taxpayers will continue looking abroad to avoid taxation and, countries, looking for additional revenues, will provide opportunities. As a result, tax competition intensifies and the initial increase in compliance could reverse. To avoid international tax reforms being counteracted by tax competition, this paper suggests bilateral responsive regulation to maximize compliance. This implies that countries would use different tax policy instruments toward other countries, including tax and secrecy havens.

To assess the effectiveness of fully or partially enforce tax policies, this agent based model has been ran many times under different enforcement rules, which influence the perceived enforced- and voluntary compliance, as the slippery-slope model prescribes. Based on the dynamics of this perception and the extent to which agents influence each other, the annual amounts of tax evasion, tax avoidance and taxes paid are calculated over longer periods of time.

The agent-based simulation finds that a differentiated policy response could increase tax compliance by 6.54 percent, which translates into an annual increase of €105 billion in EU tax revenues on income, profits, and capital gains. Corporate income tax revenues in France, Spain, and the UK alone would already account for €35 billion.

Netlogo model ` Effect of Network Homophily and Partisanship on Social Media to “Oil Spill” Polarizations’

takuya nagura | Published Saturday, September 13, 2025This model was utilized for the simulation in the paper titled Effect of Network Homophily and Partisanship on Social Media to “Oil Spill” Polarizations. It allows you to examine whether oil spill polarization occurs through people’s communication under various conditions.

・Choose the network construction conditions you’d like to examine from the “rewire-style” chooser box.

・Select the desired strength of partisanship from the “partisanlevel” chooser box. You can also set the strength manually in the code tab.

・You can set the number of dynamic topics using the “number-of-topics” slider.

・Use the “divers-of-opinion” slider to set the number of preference types for each dynamic topic.

…

ReMoTe-S. Residential Mobility of Tenants in Switzerland: an agent-based model

Claudia Binder Anna Pagani Francesco Ballestrazzi Emanuele Massaro | Published Friday, April 01, 2022ReMoTe-S is an agent-based model of the residential mobility of Swiss tenants. Its goal is to foster a holistic understanding of the reciprocal influence between households and dwellings and thereby inform a sustainable management of the housing stock. The model is based on assumptions derived from empirical research conducted with three housing providers in Switzerland and can be used mainly for two purposes: (i) the exploration of what if scenarios that target a reduction of the housing footprint while accounting for households’ preferences and needs; (ii) knowledge production in the field of residential mobility and more specifically on the role of housing functions as orchestrators of the relocation process.

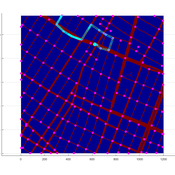

Agent-based model of WiFi tracking system in urban environment

Christopher Thron Khoi Tran | Published Friday, April 21, 2017This code simulates the WiFi user tracking system described in: Thron et al., “Design and Simulation of Sensor Networks for Tracking Wifi Users in Outdoor Urban Environments”. Testbenches used to create the figures in the paper are included.

Hybrid Climate Assessment Model (HCAM)

Peer-Olaf Siebers | Published Friday, February 15, 2019Our Hybrid Climate Assessment Model (HCAM) aims to simulate the behaviours of individuals under the influence of climate change and external policy makings. In our proposed solution we use System Dynamics (SD) modelling to represent the physical and economic environments. Agent-Based (AB) modelling is used to represent collections of individuals that can interact with other collections of individuals and the environment. In turn, individual agents are endowed with an internal SD model to track their psychological state used for decision making. In this paper we address the feasibility of such a scalable hybrid approach as a proof-of-concept. This novel approach allows us to reuse existing rigid, but well-established Integrated Assessment Models (IAMs), and adds more flexibility by replacing aggregate stocks with a community of vibrant interacting entities.

Our illustrative example takes the settings of the U.S., a country that contributes to the majority of the global carbon footprints and that is the largest economic power in the world. The model considers the carbon emission dynamics of individual states and its relevant economic impacts on the nation over time.

Please note that the focus of the model is on a methodological advance rather than on applying it for predictive purposes! More details about the HCAM are provided in the forthcoming JASSS paper “An Innovative Approach to Multi-Method Integrated Assessment Modelling of Global Climate Change”, which is available upon request from the authors (contact [email protected]).

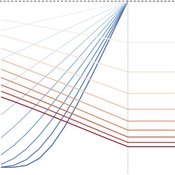

Peer reviewed Price Evolution with Expectations

J M Applegate Gesine Steudel Armin Haas Carlo Jaeger | Published Friday, September 10, 2021The Price Evolution with Expectations model provides the opportunity to explore the question of non-equilibrium market dynamics, and how and under which conditions an economic system converges to the classically defined economic equilibrium. To accomplish this, we bring together two points of view of the economy; the classical perspective of general equilibrium theory and an evolutionary perspective, in which the current development of the economic system determines the possibilities for further evolution.

The Price Evolution with Expectations model consists of a representative firm producing no profit but producing a single good, which we call sugar, and a representative household which provides labour to the firm and purchases sugar.The model explores the evolutionary dynamics whereby the firm does not initially know the household demand but eventually this demand and thus the correct price for sugar given the household’s optimal labour.

The model can be run in one of two ways; the first does not include money and the second uses money such that the firm and/or the household have an endowment that can be spent or saved. In either case, the household has preferences for leisure and consumption and a demand function relating sugar and price, and the firm has a production function and learns the household demand over a set number of time steps using either an endogenous or exogenous learning algorithm. The resulting equilibria, or fixed points of the system, may or may not match the classical economic equilibrium.

Displaying 10 of 334 results for "Chelsea E Hunter" clear search