About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 50 results for "Matthias Mueller" clear search

Bargaining with misvaluation

Marcin Czupryna | Published Wednesday, January 14, 2026Subjective biases and errors systematically affect market equilibria, whether at the population level or in bilateral trading. Here, we consider the possibility that an agent engaged in bilateral trading is mistaken about her own valuation of the good she expects to trade, that has not been explicitly incorporated into the existing bilateral trade literature. Although it may sound paradoxical that a subjective private valuation is something an agent can be mistaken about, as it is up to her to fix it, we consider the case in which that agent, seller or buyer, consciously or not, given the structure of a market, a type of good, and a temporary lack of information, may arrive at an erroneous valuation. The typical context through which this possibility may arise is in relation with so-called experience goods, which are sold while all their intrinsic qualities are still unknown (such as untasted bottled fine wines). We model this “private misvaluation” phenomenon in our study. The agents may also be mistaken about how their exchange counterparties are themselves mistaken. Formally, they attribute a certain margin of error to the other agent, which can differ from the actual way that another agent misvalues the good under consideration. This can constitute the source of a second-order misvaluation. We model different attitudes and situations in which agents face unexpected signals from their counterparties and the manner and extent to which they revise their initial beliefs. We analyse and simulate numerically the consequences of first-order and second-order misvaluation on market equilibria.

SimPLS - The PLS Agent

Iris Lorscheid Sandra Schubring Matthias Meyer Christian Ringle | Published Monday, April 18, 2016 | Last modified Tuesday, May 17, 2016The simulation model SimPLS shows an application of the PLS agent concept, using SEM as empirical basis for the definition of agent architectures. The simulation model implements the PLS path model TAM about the decision of using innovative products.

Multistate modeling extended by behavioral rules

Frans Willekens Sabine Zinn Matthias Leuchter Anna Klabunde | Published Wednesday, August 03, 2016 | Last modified Tuesday, March 13, 2018Toolkit to specify demographic multistate model with a behavioural element linking intentions to behaviour

Generic servicising model (SPREE project)

Igor Nikolic Reinier Van Der Veen Kasper H Kisjes | Published Wednesday, August 26, 2015 | Last modified Wednesday, September 28, 2016This generic agent-based model allows the user to simulate and explore the influence of servicising policies on the uptake of servicising and on economic, environmental and social effects, notably absolute decoupling.

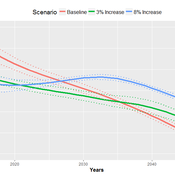

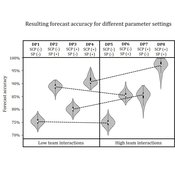

Demand Planning Model

Iris Lorscheid Jonas Hauke Matthias Meyer | Published Wednesday, October 04, 2017Demand planning requires processing of distributed information. In this process, individuals, their properties and interactions play a crucial role. This model is a computational testbed to investigate these aspects with respect to forecast accuracy.

An agent-based simulation of discussion processes in risk workshops

Matthias Meyer Clemens Harten Lucia Bellora-Bienengräber | Published Thursday, September 30, 2021The model measures drivers of effectiveness of risk assessments in risk workshops regarding the correctness and required time. Specifically, we model the limits to information transfer, incomplete discussions, group characteristics, and interaction patterns and investigate their effect on risk assessment in risk workshops.

The model simulates a discussion in the context of a risk workshop with 9 participants. The participants use Bayesian networks to assess a given risk individually and as a group.

Agent-based simulation of discussion processes in risk workshops with quantitative skepticism

Matthias Meyer Clemens Harten Lucia Bellora-Bienengräber | Published Sunday, August 14, 2022The model measures drivers of effectiveness of risk assessments in risk workshops where a calculative culture of quantitative skepticism is present. We model the limits to information transfer, incomplete discussions, group characteristics, and interaction patterns and investigate their effect on risk assessment in risk workshops, in order to contrast results to a previous model focused on a calculative culture of quantitative enthusiasm.

The model simulates a discussion in the context of a risk workshop with 9 participants. The participants use constraint satisfaction networks to assess a given risk individually and as a group.

Team Cognition

Iris Lorscheid | Published Sunday, May 23, 2021The teamCognition model investigates team decision processes by using an agent-based model to conceptualize team decisions as an emergent property. It uses a mixed-method research design with a laboratory experiment providing qualitative and quantitative input for the model’s construction, as well as data for an output validation of the model. The agent-based model is used as a computational testbed to contrast several processes of team decision making, representing potential, simplified mechanisms of how a team decision emerges. The increasing overall fit of the simulation and empirical results indicates that the modeled decision processes can at least partly explain the observed team decisions.

Peer reviewed Descriptive Norm and Fraud Dynamics

Alexandra Eckert Matthias Meyer Christian Stindt | Published Tuesday, January 07, 2025The “Descriptive Norm and Fraud Dynamics” model demonstrates how fraudulent behavior can either proliferate or be contained within non-hierarchical organizations, such as peer networks, through social influence taking the form of a descriptive norm. This model expands on the fraud triangle theory, which posits that an individual must concurrently possess a financial motive, perceive an opportunity, and hold a pro-fraud attitude to engage in fraudulent activities (red agent). In the absence of any of these elements, the individual will act honestly (green agent).

The model explores variations in a descriptive norm mechanism, ranging from local distorted knowledge to global perfect knowledge. In the case of local distorted knowledge, agents primarily rely on information from their first-degree colleagues. This knowledge is often distorted because agents are slow to update their empirical expectations, which are only partially revised after one-to-one interactions. On the other end of the spectrum, local perfect knowledge is achieved by incorporating a secondary source of information into the agents’ decision-making process. Here, accurate information provided by an observer is used to update empirical expectations.

The model shows that the same variation of the descriptive norm mechanism could lead to varying aggregate fraud levels across different fraud categories. Two empirically measured norm sensitivity distributions associated with different fraud categories can be selected into the model to see the different aggregate outcomes.

A Generic Java Learning Classifier Library

Klaus Hufschlag | Published Friday, April 09, 2010 | Last modified Thursday, February 23, 2017Complete Library for object oriented development of Classifier Systems. See for the concept behind.

Displaying 10 of 50 results for "Matthias Mueller" clear search