About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 195 results for "Michel De Garine-Wichatitsky" clear search

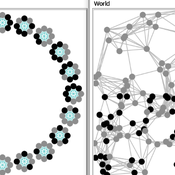

Two agent-based models of cooperation in dynamic groups and fixed social networks

Carlos A. de Matos Fernandes | Published Thursday, January 20, 2022Both models simulate n-person prisoner dilemma in groups (left figure) where agents decide to C/D – using a stochastic threshold algorithm with reinforcement learning components. We model fixed (single group ABM) and dynamic groups (bad-barrels ABM). The purpose of the bad-barrels model is to assess the impact of information during meritocratic matching. In the bad-barrels model, we incorporated a multidimensional structure in which agents are also embedded in a social network (2-person PD). We modeled a random and homophilous network via a random spatial graph algorithm (right figure).

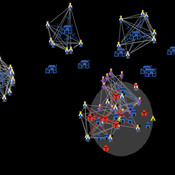

Peer reviewed Emergent Firms Model

J M Applegate | Published Friday, July 13, 2018The Emergent Firm (EF) model is based on the premise that firms arise out of individuals choosing to work together to advantage themselves of the benefits of returns-to-scale and coordination. The Emergent Firm (EF) model is a new implementation and extension of Rob Axtell’s Endogenous Dynamics of Multi-Agent Firms model. Like the Axtell model, the EF model describes how economies, composed of firms, form and evolve out of the utility maximizing activity on the part of individual agents. The EF model includes a cash-in-advance constraint on agents changing employment, as well as a universal credit-creating lender to explore how costs and access to capital affect the emergent economy and its macroeconomic characteristics such as firm size distributions, wealth, debt, wages and productivity.

Simulation model replicating the five different games that were run during a workshop of the TISSS Lab

tissslab | Published Friday, April 30, 2021The three-day participatory workshop organized by the TISSS Lab had 20 participants who were academics in different career stages ranging from university student to professor. For each of the five games, the participants had to move between tables according to some pre-specified rules. After the workshop both the participant’s perception of the games’ complexities and the participants’ satisfaction with the games were recorded.

In order to obtain additional objective measures for the games’ complexities, these games were also simulated using this simulation model here. Therefore, the simulation model is an as-accurate-as-possible reproduction of the workshop games: it has 20 participants moving between 5 different tables. The rules that specify who moves when vary from game to game. Just to get an idea, Game 3 has the rule: “move if you’re sitting next to someone who is waring white or no socks”.

An exact description of the workshop games and the associated simulation models can be found in the paper “The relation between perceived complexity and happiness with decision situations: searching for objective measures in social simulation games”.

SimDrink: An agent-based NetLogo model of young, heavy drinkers for conducting alcohol policy experiments

Nick Scott James Wilson Michael Livingston Aaron Hart David Moore Paul Dietze | Published Friday, September 25, 2015 | Last modified Thursday, October 15, 2015A proof-of-concept agent-based model ‘SimDrink’, which simulates a population of 18-25 year old heavy alcohol drinkers on a night out in Melbourne to provide a means for conducting policy experiments to inform policy decisions.

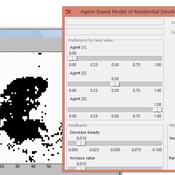

IDEAL

Arika Ligmann-Zielinska | Published Thursday, August 07, 2014IDEAL: Agent-Based Model of Residential Land Use Change where the choice of new residential development in based on the Ideal-point decision rule.

SMILI: Small-scale fisheries Institutions and Local Interactions

Emilie Lindkvist Maja Schlüter Xavier Basurto | Published Thursday, March 09, 2017The model represents an archetypical fishery in a co-evolutionary social-ecological environment, capturing different dimensions of trust between fishers and fish buyers for the establishment and persistence of self-governance arrangements.

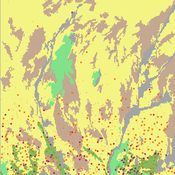

TREELIM

Gudrun Wallentin | Published Wednesday, November 30, 2016 | Last modified Tuesday, January 10, 2017The model simulates the spatial patterns of secondary forest succession above the current alpine tree line in the context of land use and climate change. Three scenarios are offered: (1) climate change, (2) land use change, (3) species composition.

MCR Model

Davide Secchi Nuno R Barros De Oliveira | Published Friday, July 22, 2016 | Last modified Saturday, January 23, 2021The aim of the model is to define when researcher’s assumptions of dependence or independence of cases in multiple case study research affect the results — hence, the understanding of these cases.

An agent-based artificial stock with a dynamic investor network

Matthew Oldham | Published Tuesday, June 25, 2019The model is an agent-based artificial stock market where investors connect in a dynamic network. The network is dynamic in the sense that the investors, at specified intervals, decide whether to keep their current adviser (those investors they receive trading advise from). The investors also gain information from a private source and share public information about the risky asset. Investors have different tendencies to follow the different information sources, consider differing amounts of history, and have different thresholds for investing.

Exploring homeowners' insulation activity

Georg Holtz Emile Chappin Jonas Friege | Published Monday, June 01, 2015 | Last modified Monday, April 08, 2019We built an agent-based model to foster the understanding of homeowners’ insulation activity.

Displaying 10 of 195 results for "Michel De Garine-Wichatitsky" clear search