About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 810 results for "Jon Solera" clear search

A model on feeding and social interaction behaviour of pigs

Iris J.M.M. Boumans | Published Thursday, May 04, 2017 | Last modified Tuesday, February 27, 2018The model simulates interaction between internal physiological factors (e.g. energy balance) and external social factors (e.g. competition level) underlying feeding and social interaction behaviour of commercially group-housed pigs.

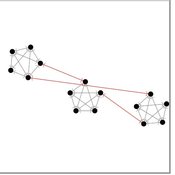

Impact of topography and climate change on Magdalenian social networks

Claudine Gravel-Miguel | Published Monday, September 11, 2017The model presented here was created as part of my dissertation. It aims to study the impacts of topography and climate change on prehistoric networks, with a focus on the Magdalenian, which is dated to between 20 and 14,000 years ago.

A Comparative Study on Apprenticeship Systems Using Agent-Based Simulation

Amir Hosein Afshar Sedigh | Published Thursday, October 21, 2021The model is suitable to investigate the effects of different characteristics of apprenticeship programmes both in historical and contemporary societies. The model is built considering five societies, using an agent-based simulation model, we identified six main characteristics which impact the success of an apprenticeship programme in a society, which we measured by considering three parameters, namely the number of skilled agents produced by the apprenticeships, programme completion, and the contribution of programmes in the Gross Domestic Income (GDI) of the society. We investigate different definitions for success of an apprenticeship and some hypothetical societies to test some common beliefs about apprenticeships performance. The model also shows the number of unemployed agents given their work-based skills, wages, and the number of small and large companies who participate in training agents. The model enables exploring the impact of parameters, such as initial wages and the number of training years, along with the stated policies on the system.

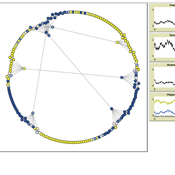

The influence of cognitive diversity on networked search and coordination

César García-Díaz | Published Wednesday, April 03, 2024Agent-based models of organizational search have long investigated how exploitative and exploratory behaviors shape and affect performance on complex landscapes. To explore this further, we build a series of models where agents have different levels of expertise and cognitive capabilities, so they must rely on each other’s knowledge to navigate the landscape. Model A investigates performance results for efficient and inefficient networks. Building on Model B, it adds individual-level cognitive diversity and interaction based on knowledge similarity. Model C then explores the performance implications of coordination spaces. Results show that totally connected networks outperform both hierarchical and clustered network structures when there are clear signals to detect neighbor performance. However, this pattern is reversed when agents must rely on experiential search and follow a path-dependent exploration pattern.

On the liquidity of the illiquid (hard-to-trade) assets

Marcin Czupryna | Published Monday, January 13, 2025This paper investigates the impact of agents' trading decisions on market liquidity and transactional efficiency in markets for illiquid (hard-to-trade) assets. Drawing on a unique order book dataset from the fine wine exchange Liv-ex, we offer novel insights into liquidity dynamics in illiquid markets. Using an agent-based framework, we assess the adequacy of conventional liquidity measures in capturing market liquidity and transactional efficiency. Our main findings reveal that conventional liquidity measures, such as the number of bids, asks, new bids and new asks, may not accurately represent overall transactional efficiency. Instead, volume (measured by the number of trades) and relative spread measures may be more appropriate indicators of liquidity within the context of illiquid markets. Furthermore, our simulations demonstrate that a greater number of traders participating in the market correlates with an increased efficiency in trade execution, while wider trader-set margins may decrease the transactional efficiency. Interestingly, the trading period of the agents appears to have a significant impact on trade execution. This suggests that granting market participants additional time for trading (for example, through the support of automated trading systems) can enhance transactional efficiency within illiquid markets. These insights offer practical implications for market participants and policymakers aiming to optimise market functioning and liquidity.

Hybrid Agent-Based and Equation Based Model for Infectious Disease Spread

Elizabeth Hunter Brian Mac Namee John Kelleher | Published Sunday, April 19, 2020Our model is hybrid agent-based and equation based model for human air-borne infectious diseases measles. It follows an SEIR (susceptible, exposed,infected, and recovered) type compartmental model with the agents moving be-tween the four state relating to infectiousness. However, the disease model canswitch back and forth between agent-based and equation based depending onthe number of infected agents. Our society model is specific using the datato create a realistic synthetic population for a county in Ireland. The modelincludes transportation with agents moving between their current location anddesired destination using predetermined destinations or destinations selectedusing a gravity model.

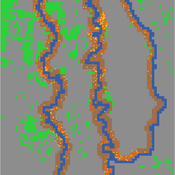

Peer reviewed Simulating the Economic Impact of Boko Haram on a Cameroonian Floodplain

Mark Moritz Nathaniel Henry Sarah Laborde | Published Saturday, October 22, 2016 | Last modified Wednesday, June 07, 2017This model examines the potential impact of market collapse on the economy and demography of fishing households in the Logone Floodplain, Cameroon.

Simulation of the Effects of Disorganization on Goals and Problem Solving

Dinuka Herath | Published Sunday, August 13, 2017 | Last modified Sunday, August 13, 2017This is a model of the occurrence of disorganization and its impact on individual goal setting and problem-solving. This model therefore, explores the effects of disorganization on goal achievement.

An Agent-Based Model of Indirect Minority Influence on Social Change

Jiin Jung | Published Wednesday, February 05, 2025This model demonstrates how different psychological mechanisms and network structures generate various patterns of cultural dynamics including cultural diversity, polarization, and majority dominance, as explored by Jung, Bramson, Crano, Page, and Miller (2021). It focuses particularly on the psychological mechanisms of indirect minority influence, a concept introduced by Serge Moscovici (1976, 1980)’s genetic model of social influence, and validates how such influence can lead to social change.

ACT: Agent-based model of Critical Transitions

Igor Nikolic Oscar Kraan Steven Dalderop Gert Jan Kramer | Published Wednesday, October 18, 2017 | Last modified Monday, August 27, 2018ACT is an ABM based on an existing conceptualisation of the concept of critical transitions applied to the energy transition. With the model we departed from the mean-field approach simulated relevant actor behaviour in the energy transition.

Displaying 10 of 810 results for "Jon Solera" clear search