About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1110 results for "Oto Hudec" clear search

The Evolution of Tribalism: A Social-Ecological Model of Cooperation and Inter-group Conflict Under Pastoralism

Nicholas Seltzer | Published Monday, January 21, 2019This study investigates a possible nexus between inter-group competition and intra-group cooperation, which may be called “tribalism.” Building upon previous studies demonstrating a relationship between the environment and social relations, the present research incorporates a social-ecological model as a mediating factor connecting both individuals and communities to the environment. Cyclical and non-cyclical fluctuation in a simple, two-resource ecology drive agents to adopt either “go-it-alone” or group-based survival strategies via evolutionary selection. Novelly, this simulation employs a multilevel selection model allowing group-level dynamics to exert downward selective pressures on individuals’ propensity to cooperate within groups. Results suggest that cooperation and inter-group conflict are co-evolved in a triadic relationship with the environment. Resource scarcity increases inter-group competition, especially when resources are clustered as opposed to widely distributed. Moreover, the tactical advantage of cooperation in the securing of clustered resources enhanced selective pressure on cooperation, even if that implies increased individual mortality for the most altruistic warriors. Troubling, these results suggest that extreme weather, possibly as a result of climate change, could exacerbate conflict in sensitive, weather-dependent social-ecologies—especially places like the Horn of Africa where ecologically sensitive economic modalities overlap with high-levels of diversity and the wide-availability of small arms. As well, global development and foreign aid strategists should consider how plans may increase the value of particular locations where community resources are built or aid is distributed, potentially instigating tribal conflict. In sum, these factors, interacting with pre-existing social dynamics dynamics, may heighten inter-ethnic or tribal conflict in pluralistic but otherwise peaceful communities.

For special issue submission in JASSS.

Cultural Evolution of Sustainable Behaviours: Landscape of Affordances Model

Nikita Strelkovskii Roope Oskari Kaaronen | Published Wednesday, December 04, 2019 | Last modified Wednesday, December 04, 2019This NetLogo model illustrates the cultural evolution of pro-environmental behaviour patterns. It illustrates how collective behaviour patterns evolve from interactions between agents and agents (in a social network) as well as agents and the affordances (action opportunities provided by the environment) within a niche. More specifically, the cultural evolution of behaviour patterns is understood in this model as a product of:

- The landscape of affordances provided by the material environment,

- Individual learning and habituation,

- Social learning and network structure,

- Personal states (such as habits and attitudes), and

…

ABM thesis

Lucas Sage | Published Friday, May 06, 2022Netlogo model used to produce the results in my doctoral thesis

An Agent-Based Model of Corruption: Micro Approach

Valery Dzutsati | Published Friday, January 30, 2015 | Last modified Sunday, September 27, 2015Endogenous social transition from a high-corruption state to a low-corruption state, replication of Hammond 2009

Peer reviewed HUMLAND FIRE-IN-THE-HOLE agent-based model

Fulco Scherjon Anastasia Nikulina | Published Monday, October 20, 2025HUMLAND Fire-in-the-Hole is a conceptual agent-based model (ABM) designed to explore the ecological and behavioral consequences of fire-driven hunting strategies employed by hunter-gatherers, specifically Neanderthals, during the Last Interglacial period around the Neumark-Nord (Germany) archaeological site.

This model builds on and specializes the HUMLAND 1.0.0 model (Nikulina et al. 2024), integrating anthropogenic fires, elephant group behavior, and landscape response to simulate interactions between humans, megafauna, and vegetation over time.

An Agent-Based Model of Farmland Trading Partners Selection

Hang Xiong Chen Yuxin Xinfan Wang | Published Tuesday, August 19, 2025This base model uses an agent-based approach to represent heterogeneous farmers’ trading partners selection among multiple recipients (other farmers, village collectives, and firms). Each period, a potential transfer-out farmer decides whether to transfer based on a net-return versus transaction-cost trade-off; if transferring, the farmer selects the counterparty with the highest expected profit. Meanwhile, social learning—operationalized as logistic accumulation of neighborhood experience—continuously updates uncertainty, which in turn shapes transaction costs and subsequent decisions.

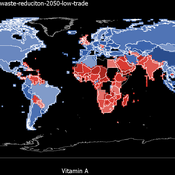

FeedUS - A global food trade model

Jiaqi Ge | Published Thursday, February 25, 2021 | Last modified Friday, February 26, 2021The purpose of the model is to study the impact of global food trade on food and nutrition security in countries around the world. It will incorporate three main aspects of trade between countries, including a country’s wealth, geographic location, and its trade relationships with other countries (past and ongoing), and can be used to study food and nutrition security across countries in various scenarios, such as climate change, sustainable intensification, waste reduction and dietary change.

Model of communication between two groups of managers in the course of project implementation

Smarzhevskiy Ivan | Published Monday, December 07, 2020This is a simulation model of communication between two groups of managers in the course of project implementation. The “world” of the model is a space of interaction between project participants, each of which belongs either to a group of work performers or to a group of customers. Information about the progress of the project is publicly available and represents the deviation Earned value (EV) from the planned project value (cost baseline).

The key elements of the model are 1) persons belonging to a group of customers or performers, 2) agents that are communication acts. The life cycle of persons is equal to the time of the simulation experiment, the life cycle of the communication act is 3 periods of model time (for the convenience of visualizing behavior during the experiment). The communication act occurs at a specific point in the model space, the coordinates of which are realized as random variables. During the experiment, persons randomly move in the model space. The communication act involves persons belonging to a group of customers and a group of performers, remote from the place of the communication act at a distance not exceeding the value of the communication radius (MaxCommRadius), while at least one representative from each of the groups must participate in the communication act. If none are found, the communication act is not carried out. The number of potential communication acts per unit of model time is a parameter of the model (CommPerTick).

The managerial sense of the feedback is the stimulating effect of the positive value of the accumulated communication complexity (positive background of the project implementation) on the productivity of the performers. Provided there is favorable communication (“trust”, “mutual understanding”) between the customer and the contractor, it is more likely that project operations will be performed with less lag behind the plan or ahead of it.

The behavior of agents in the world of the model (change of coordinates, visualization of agents’ belonging to a specific communicative act at a given time, etc.) is not informative. Content data are obtained in the form of time series of accumulated communicative complexity, the deviation of the earned value from the planned value, average indicators characterizing communication - the total number of communicative acts and the average number of their participants, etc. These data are displayed on graphs during the simulation experiment.

The control elements of the model allow seven independent values to be varied, which, even with a minimum number of varied values (three: minimum, maximum, optimum), gives 3^7 = 2187 different variants of initial conditions. In this case, the statistical processing of the results requires repeated calculation of the model indicators for each grid node. Thus, the set of varied parameters and the range of their variation is determined by the logic of a particular study and represents a significant narrowing of the full set of initial conditions for which the model allows simulation experiments.

…

Agent-based model of sexual partnership

Andrea Knittel | Published Monday, December 05, 2011 | Last modified Saturday, April 27, 2013In this model agents meet, evaluate one another, decide whether or not to date, if and when to become sexual partners, and when to break up.

Setting the Stage for Inequality

Timothy Dennehy | Published Monday, March 11, 2013 | Last modified Saturday, April 27, 2013How can a strictly egalitarian social system give way to a stratified society if all of its members punish each other for any type of selfish behavior? This model examines the role of prestige bias in constant and variable environments on the development of hierarchies of wealth.

Displaying 10 of 1110 results for "Oto Hudec" clear search