About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1170 results for "Aad Kessler" clear search

Cliff Walking with Q-Learning NetLogo Extension

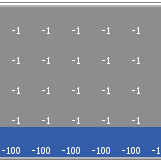

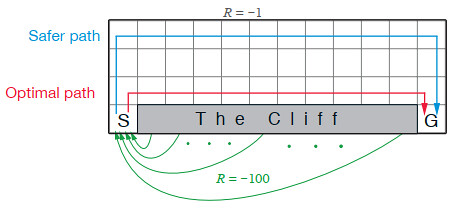

Kevin Kons Fernando Santos | Published Tuesday, December 10, 2019This model implements a classic scenario used in Reinforcement Learning problem, the “Cliff Walking Problem”. Consider the gridworld shown below (SUTTON; BARTO, 2018). This is a standard undiscounted, episodic task, with start and goal states, and the usual actions causing movement up, down, right, and left. Reward is -1 on all transitions except those into the region marked “The Cliff.” Stepping into this region incurs a reward of -100 and sends the agent instantly back to the start (SUTTON; BARTO, 2018).

The problem is solved in this model using the Q-Learning algorithm. The algorithm is implemented with the support of the NetLogo Q-Learning Extension

The Internal Organizational Plasticity Model (IOP 2.1.2)

Davide Secchi | Published Tuesday, June 02, 2020IOP 2.1.2 is an agent-based simulation model designed to explore the relations between (1) employees, (2) tasks and (3) resources in an organizational setting. By comparing alternative cognitive strategies in the use of resources, employees face increasingly demanding waves of tasks that derive by challenges the organization face to adapt to a turbulent environment. The assumption tested by this model is that a successful organizational adaptation, called plastic, is necessarily tied to how employees handle pressure coming from existing and new tasks. By comparing alternative cognitive strategies, connected to ‘docility’ (Simon, 1993; Secchi, 2011) and ‘extended’ cognition (Clark, 2003, Secchi & Cowley, 2018), IOP 2.1.2 is an attempt to indicate which strategy is most suitable and under which scenario.

This model was developed to test the usability of evolutionary computing and reinforcement learning by extending a well known agent-based model. Sugarscape (Epstein & Axtell, 1996) has been used to demonstrate migration, trade, wealth inequality, disease processes, sex, culture, and conflict. It is on conflict that this model is focused to demonstrate how machine learning methodologies could be applied.

The code is based on the Sugarscape 2 Constant Growback model, availble in the NetLogo models library. New code was added into the existing model while removing code that was not needed and modifying existing code to support the changes. Support for the original movement rule was retained while evolutionary computing, Q-Learning, and SARSA Learning were added.

CITMOD A Tax-Benefit Modeling System for the average citizen

Philip Truscott | Published Monday, August 15, 2011 | Last modified Saturday, April 27, 2013Must tax-benefit policy making be limited to the ‘experts’?

A social network model to analyze team assembly mechanisms

Andreas Koch | Published Monday, April 10, 2017This model simulates networking mechanisms of an empirical social network. It correlates event determinants with place-based geography and social capital production.

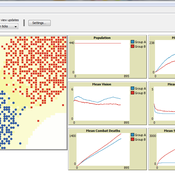

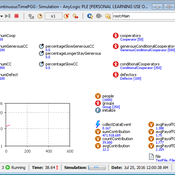

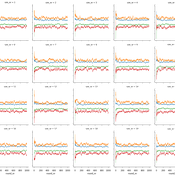

An Agent-Based Simulation of Continuous-Time Public Goods Games

Tuong Manh Vu | Published Thursday, May 17, 2018 | Last modified Tuesday, April 02, 2019To our knowledge, this is the first agent-based simulation of continuous-time PGGs (where participants can change contributions at any time) which are much harder to realise within both laboratory and simulation environments.

Work related to this simulation has been published in the following journal article:

Vu, Tuong Manh, Wagner, Christian and Siebers, Peer-Olaf (2019) ‘ABOOMS: Overcoming the Hurdles of Continuous-Time Public Goods Games with a Simulation-Based Approach’ Journal of Artificial Societies and Social Simulation 22 (2) 7 http://jasss.soc.surrey.ac.uk/22/2/7.html. doi: 10.18564/jasss.3995

Abstract:

…

TELL ME: protective behaviour in an epidemic

Jennifer Badham | Published Tuesday, February 10, 2015Models the connection between health agency communication, personal protective behaviour (eg vaccination, hand hygiene) and influenza transmission.

This is an agent-based model that simulates the structural evolution in food supply chain.

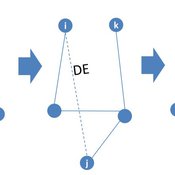

Adaptive model of a consumer advice network

Peng Shao | Published Monday, May 14, 2018In the consumer advice network, users with connections can interact with each other, and the network topology will change during the opinion interaction. When the opinion distance from i to j is greater than the confidence threshold, the two consumers cannot exchange opinions, and the link between them will disconnect with probability DE. Then, a link from node i to node k is established with probability CE and node i learning opinion from node k.

Peer reviewed Dynamic Equilibria Prediction: Experience-Weighted Attraction (EWA), Python Implementation

Vinicius Ferraz | Published Friday, December 02, 2022This project is based on a Jupyter Notebook that describes the stepwise implementation of the EWA model in bi-matrix ( 2×2 ) strategic-form games for the simulation of economic learning processes. The output is a dataset with the simulated values of Attractions, Experience, selected strategies, and payoffs gained for the desired number of rounds and periods. The notebook also includes exploratory data analysis over the simulated output based on equilibrium, strategy frequencies, and payoffs.

Displaying 10 of 1170 results for "Aad Kessler" clear search