About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1253 results

Communication and Trust in a Commons Dilemma Experiment

Marco Janssen | Published Sunday, October 02, 2022An agent model is presented that aims to capture the impact of cheap talk on collective action in a commons dilemma. The commons dilemma is represented as a spatially explicit renewable resource. Agent’s trust in others impacts the speed and harvesting rate, and trust is impacted by observed harvesting behavior and cheap talk. We calibrated the model using experimental data (DeCaro et al. 2021). The best fit to the data consists of a population with a small frequency of altruistic and selfish agents, and mostly conditional cooperative agents sensitive to inequality and cheap talk. This calibrated model provides an empirical test of the behavioral theory of collective action of Elinor Ostrom and Humanistic Rational Choice Theory.

Identity and meat eating behaviour

Jiaqi Ge | Published Thursday, September 29, 2022Using data from the British Social Attitude Survey, we develop an agent-based model to study the effect of social influence on the spread of meat-eating behaviour in the British population.

WATER REUSE ADOPTION BY FARMERS (WRAF)

Farshid Shoushtarian | Published Tuesday, September 27, 2022Agriculture is the largest water-consuming sector worldwide, responsible for almost 70% of the world’s total freshwater consumption. Agricultural water reuse is one of the most sustainable and reliable methods to alleviate water shortages worldwide. However, the dynamics of agricultural water reuse adoption by farmers and its impacts on local water resources are still unknown to the scientific community, according to the literature. Therefore, the primary purpose of the WRAF model is to investigate the micro-level dynamics of agricultural water reuse adoption by farmers and its impacts on local water resources. The WRAF was developed using agent-based modeling as an exploratory tool for scenario analysis. The model was specifically designed for researchers and water resources decision-makers, especially those interested in natural resources management and water reuse.

WRAF simulates a virtual agricultural area in which several autonomous farms operate. It also simulates these farms’ water consumption dynamics. The developed model includes two types of agents: farmers and wastewater treatment plants. In general, farmer agents are the main water-consuming agents, and wastewater treatment plant agents are recycled water providers in the WRAF model. Dynamic simulation of agricultural water supply and demand in the area allows the user to observe the results of various irrigation water management scenarios, including recycled water. The models also enable the user to apply multiple climate change scenarios, including normal, moderate drought, severe drought, and wet weather conditions.

An integrated socio-economic Agent-Based Modeling framework towards assessing farmers’ decision making under water scarcity and varying utility function

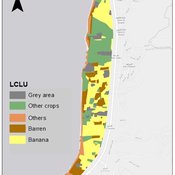

Ghinwa Harik | Published Tuesday, September 13, 2022 | Last modified Wednesday, November 23, 2022A spatio-temporal Agent Based Modeling (ABM) framework is developed to probabilistically predict farmers’ decisions in the context of climate-induced water scarcity under varying utility optimization functions. The proposed framework forecasts farmers’ behavior assuming varying utility functions. The framework allows decision makers to forecast the behavior of farmers through a user-friendly platform with clear output visualization. The functionality of the proposed ABM is illustrated in an agriculturally dominated plain along the Eastern Mediterranean coastline.

Study area GIS data available upon request to [email protected]

Digital-Twin model of Sejong City

Tae-Sub Yun | Published Wednesday, August 31, 2022Digital-Twin model of Sejong City – Source model code & data

We only shared model codes, excluding private data and simulation engine codes.

The followings are brief reasons for the items we cannot share.

- Residence address data

…

The spread of scientific methods within and between communities

Paul Smaldino Cailin O'Connor | Published Monday, August 29, 2022We consider scientific communities where each scientist employs one of two characteristic methods: an “adequate” method (A) and a “superior” method (S). The quality of methodology is relevant to the epistemic products of these scientists, and generate credit for their users. Higher-credit methods tend to be imitated, allowing to explore whether communities will adopt one method or the other. We use the model to examine the effects of (1) bias for existing methods, (2) competence to assess relative value of competing methods, and (3) two forms of interdisciplinarity: (a) the tendency for members of a scientific community to receive meaningful credit assignment from those outside their community, and (b) the tendency to consider new methods used outside their community. The model can be used to show how interdisciplinarity can overcome the effects of bias and incompetence for the spread of superior methods.

Individual Heights and Phase Transition under Emergences: Agent-Based Modeling from 2D to 3D

zhuo zhang | Published Saturday, August 27, 2022We use an agent-based 3D model to reveal the behavioral dynamics of real-world cases. The target of the simulation is the Peshawar massacre. The previous 2-D model has three main problems which can be solved by our 3-D model. Under the key action rules, our model matches the real target case exactly. Based on the optimal solution, we precisely match the results of the real cases, such as the number of deaths and injuries. We also explore the importance of adding height (constructed as a 3D model) to the model.

Peer reviewed Personnel decisions in the hierarchy

Smarzhevskiy Ivan | Published Friday, August 19, 2022This is a model of organizational behavior in the hierarchy in which personnel decisions are made.

The idea of the model is that the hierarchy, busy with operations, is described by such characteristics as structure (number and interrelation of positions) and material, filling these positions (persons with their individual performance). A particular hierarchy is under certain external pressure (performance level requirement) and is characterized by the internal state of the material (the distribution of the perceptions of others over the ensemble of persons).

The World of the model is a four-level hierarchical structure, consisting of shuff positions of the top manager (zero level of the hierarchy), first-level managers who are subordinate to the top manager, second-level managers (subordinate to the first-level managers) and positions of employees (the third level of the hierarchy). ) subordinated to the second-level managers. Such a hierarchy is a tree, i.e. each position, with the exception of the position of top manager, has a single boss.

Agents in the model are persons occupying the specified positions, the number of persons is set by the slider (HumansQty). Personas have some operational performance (harisma, an unfortunate attribute name left over from the first edition of the model)) and a sense of other personas’ own perceptions. Performance values are distributed over the ensemble of persons according to the normal law with some mean value and variance.

The value of perception by agents of each other is positive or negative (implemented in the model as numerical values equal to +1 and -1). The distribution of perceptions over an ensemble of persons is implemented as a random variable specified by the probability of negative perception, the value of which is set by the control elements of the model interface. The numerical value of the probability equal to 0 corresponds to the case in which all persons positively perceive each other (the numerical value of the random variable is equal to 1, which corresponds to the positive perception of the other person by the individual).

The hierarchy is occupied with operational activity, the degree of intensity of which is set by the external parameter Difficulty. The level of productivity of each manager OAIndex is equal to the level of productivity of the department he leads and is the ratio of the sum of productivity of employees subordinate to the head to the level of complexity of the work Difficulty. An increase in the numerical value of Difficulty leads to a decrease in the OAIndex for all subdivisions of the hierarchy. The managerial meaning of the OAIndex indicator is the percentage of completion of the load specified for the hierarchy as a whole, i.e. the ratio of the actual performance of the structural subdivisions of the hierarchy to the required performance, the level of which is specified by the value of the Difficulty parameter.

…

Addressing Barriers to Primary Care Access for Latinos in the U.S.: An Agent-Based Model

S.R. Aurora (a.k.a. Mai P. Trinh) Hyunsung Oh | Published Tuesday, August 16, 2022Disparities in access to primary health care have led to health disadvantages among Latinos and other non-White racial groups. To better identify and understand which policies are most likely to improve health care for Latinos, we examined differences in access to primary care between Latinos with proficient English language skills and Latinos with limited English proficiency (LEP) and estimated the extent of access to primary care providers (PCPs) among Latinos in the U.S.

Agent-based simulation of discussion processes in risk workshops with quantitative skepticism

Matthias Meyer Clemens Harten Lucia Bellora-Bienengräber | Published Sunday, August 14, 2022The model measures drivers of effectiveness of risk assessments in risk workshops where a calculative culture of quantitative skepticism is present. We model the limits to information transfer, incomplete discussions, group characteristics, and interaction patterns and investigate their effect on risk assessment in risk workshops, in order to contrast results to a previous model focused on a calculative culture of quantitative enthusiasm.

The model simulates a discussion in the context of a risk workshop with 9 participants. The participants use constraint satisfaction networks to assess a given risk individually and as a group.

Displaying 10 of 1253 results